Brad here. One of the major concerns about the economy over the next year or so is whether consumers will keep spending. As confident as they are, it seems they will certainly want to—but it is far less clear whether they will actually be able to. Andrew Kitchings of Commonwealth’s Asset Management group has put together a good analysis of something we need to pay attention to. Over to you, Andrew.

Brad here. One of the major concerns about the economy over the next year or so is whether consumers will keep spending. As confident as they are, it seems they will certainly want to—but it is far less clear whether they will actually be able to. Andrew Kitchings of Commonwealth’s Asset Management group has put together a good analysis of something we need to pay attention to. Over to you, Andrew.

Consumers are spending and feeling good about the U.S economy. In fact, they are spending so much that the savings rate has dropped to historic lows, and consumers are increasingly taking equity out of their homes. This economic flywheel can spin freely as long as money is cheap and banks have easy standards. As interest rates inch higher and banks get a bit tougher with standards, however, the consumer tailwind could become a headwind for U.S. economic growth.

Personal savings rate

Over the longer term, the U.S. consumer has steadily saved less and less. Following recessions, consumers tend to save more until they feel more confident in the economy. Recently, consumer confidence has gone higher, while savings rates have dropped to near historic lows. In the event of a future economic hiccup, consumers will pull back their spending quickly because they have saved less during the good times.

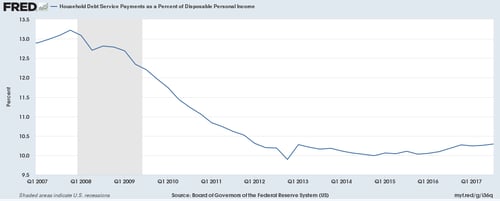

Lower debt payments

The consumer flywheel is also driven by lower debt payments. These payments are also near historic lows because of low interest rates. As interest rates inch higher, more money will be used to service debt and will not be available for consumers to spend.

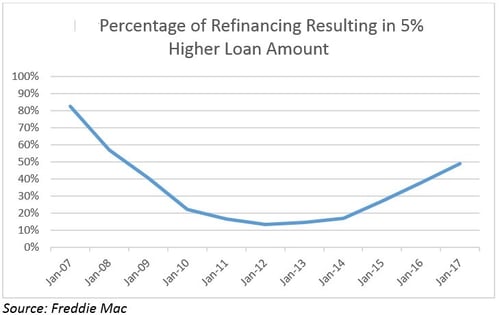

Home equity

Consumers are also starting to take equity out of their homes once again, which gives them additional money to spend. They feel comfortable doing so because they are more confident about the economy and have generally seen their houses appreciate in value. The following chart shows historical Freddie Mac refinancing data, which reflects refinancing into loans that result in a loan amount that is 5 percent higher or more. This recent uptick can be partially explained by higher housing prices, but it is also reflective of households taking additional equity out of their homes and increasing their leverage. As this percentage drifts higher, small swings in housing prices could have magnified impacts on consumers due to their increasing debt levels.

Banks tightening standards

As the U.S economy enjoys the tailwind of the consumer, banks are becoming a bit more cautious. As banks start to tap the brakes, they are tightening their standards for credit cards and loans to consumers. This, in turn, adds some resistance to the consumer flywheel.

Consumers as a headwind?

Consumers have been providing the U.S economy with a stiff tailwind. But some of this spending and optimism is fueled, once again, by overspending and increasing debt. As interest rates rise and easy money gets used up, consumers will start to be a headwind for the U.S economy. This could lead to lower-than-expected economic growth and increasing market volatility.

Print

Print