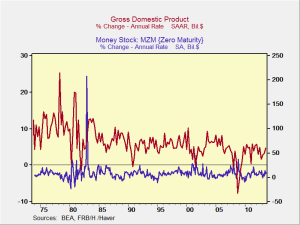

Bob Mestjian, one of our advisors and a fellow resident of Melrose, Massachusetts, wrote in with a very good question, to wit: “At the National Conference, you mentioned margin debit balances skyrocketing. However, I'm trying to reconcile skyrocketing margin debt with what I keep hearing about record levels of cash on the sidelines. Is there cash on the sidelines? Are there select investors who want to take risk ‘all in,’ using margin, while others are in cash and want nothing to do with stocks?”

Good question. First, let’s look at the concept of “cash on the sidelines.” This is a commonly used phrase, but unless the cash is actually stuffed in a mattress, it has to be somewhere in the financial system, where its removal—or relocation, really—would have effects. The phrase is usually a misnomer, as it reflects an investor preference for other asset classes over stocks.