The government shutdown came to an end last night after 43 days, making it the longest shutdown in history. We will leave it to the political commentators to pass judgment on what it means for the decision-makers in Washington. From our perspective, though, we recognize that the shutdown was beginning to have a significant impact on the economy.

The government shutdown came to an end last night after 43 days, making it the longest shutdown in history. We will leave it to the political commentators to pass judgment on what it means for the decision-makers in Washington. From our perspective, though, we recognize that the shutdown was beginning to have a significant impact on the economy.

Investors are breathing a sigh of relief now that it’s over, but important questions remain. Will there be a lasting impact on economic activity? When will economic data be reported (and will it be reported?) to help guide investors and help the Fed determine its policy decision at its upcoming meeting on December 9 and 10?

So, let’s look at what we know, what we think we know, and how it might impact markets between now and the end of the year.

The Economic Impact

The biggest impact has been felt on the local Washington, D.C., economy. Restaurant sales and reservations have declined as reduced traffic in the city has taken its toll. On a broader scale, air travel across the country has been significantly impacted, with about 900 flights canceled just yesterday. Those missed meals and canceled flights are unlikely to be made up for as the government reopens.

The White House’s Council of Economic Advisors estimated a $15 billion per week impact on economic activity. For the six-week shutdown, this would equate to about $90 billion. The Congressional Budget Office (CBO) estimated that $11 billion in lost economic activity (or roughly 12 percent) would be permanent.

The good news is that the rest of it will likely find its way back into the economy. Outside of the human impact on the more than 1 million federal employees who haven’t been paid during the shutdown, the economic effect will eventually be limited. It will take some time for that to happen; as a result, the economic data will be distorted. The CBO said that a six-week shutdown would affect fourth-quarter GDP by 1.5 percent. That is about half the rate of growth we have seen over the last couple of quarters. It also estimated first-quarter GDP would see a positive impact from the reopening that it wouldn’t otherwise have seen and that it could be as high as 2.2 percent. Over time, the impact will fade as activity returns to a normal state.

The Return of Data?

We expect the widely anticipated September employment report, originally scheduled for October 3, will be released relatively quickly. We may see it as early as Friday, as this data was collected before the shutdown. Other key September reports on retail sales and inflation should come within a week or so. Finally, the third-quarter GDP report should be released several days before the Fed meeting.

Yesterday, the White House press secretary said there is a good chance that key October data on employment and inflation won’t be released because the data was never collected. The Bureau of Labor Statistics (BLS) hasn’t yet weighed in on when or if this data will eventually be released. Either way, it is not likely to be as robust as it is under normal circumstances.

When it comes to November data, things might take a while. There will be a limited data collection period once government employees return to work. Thanksgiving week will also complicate these efforts. Normally, the November employment report is released on Friday, December 5, and it would be a key data point for Fed deliberations the following week.

What’s Next for the Fed

This uncertainty complicates things for the Fed, which wasn’t necessarily united after its meeting last month about the potential for another interest rate cut in December. Indeed, Chairman Powell went out of his way in his October post-meeting press conference to say that a cut in December was not guaranteed.

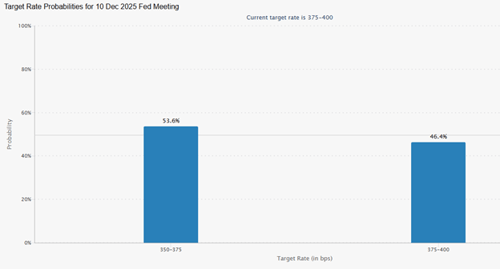

Market participants have certainly heeded that warning. Before the October meeting, the odds of another 25 bp rate cut in December were over 90 percent. While this data has been volatile, that probability is now hovering at just over 50 percent.

Source: CME FedWatch (as of 11/13/2025)

That is down from the low 60s a day ago and 70 percent a week ago. So, there is certainly a growing possibility that if the Fed doesn’t have all the information it wants or if that information doesn’t give the Fed a clear sign of further deterioration in the underlying jobs market, it might choose to pause and see what the data looks like at the time of its January 28 and 29 meeting. And once again, the funding issues haven’t been solved for long. The bill passed and signed yesterday provides appropriations only through January 30 for most of the government.

Are the Sands of the Market Shifting?

Recently, we have seen the large-cap growth stocks driven by the artificial intelligence theme show some weakness. Third-quarter earnings season seems to have brought an increased level of scrutiny for some of these companies and their potential to earn an acceptable return on the money they are spending to position themselves for the future. This has led to a 3 percent decline in the technology-heavy Nasdaq since its highest level seen a couple of weeks ago.

On the flipside, yesterday the Dow Jones Industrial Average closed over 48,000 for the first time ever. This rally has been led by what is commonly referred to as “old economy” stocks that make up the opportunity set for value investors. We are not surprised by this shift and have felt for some time that the market has been broadening, as earnings growth has been seen across multiple sectors rather than just technology.

Historically, diversified portfolios have been the best approach for investors to take during periods of uncertainty. Currently, the potential for volatility is likely heightened around the impact of the shutdown on the soon-to-be released economic data.

Print

Print