The consequences of the debt ceiling standoff and government shutdown continue to reverberate. Markets are increasingly showing signs of nervousness, with excess volatility tracking news reports as they come out of DC.

Fixed income markets showed a notable inversion this morning, with one-week-maturity Treasuries having a higher yield than two-year Treasury bonds. In essence, investors are saying—with their wallets—that they see more risk in the next week than over the next two years. Short-term rates have risen across the board since the shutdown started. This probably won’t last long, but it is a sign of the times.

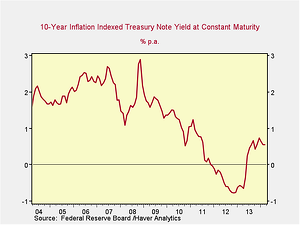

Longer-term rates have risen as well. The 10-year Treasury has started to tick up over the past five days, as shown in the following chart from MarketWatch.com:

What does all this mean? It means that the fixed income markets, at least, are starting to price in the greater risk associated with Treasury securities. Not that anyone expects default in any meaningful sense, but prices are set at the margin—and each day the risk level gets higher.

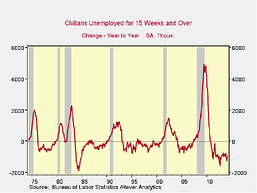

The stock market has also shown its concern over the past several days, per this chart from Google Finance:

Note especially the drop yesterday, which took us through several technical support levels. The effects of the standoff are doing considerable technical damage to the market, which is following through on support breakdowns in previous months. I’m not much of a market technician, but, historically, this has suggested caution.

None of this means the world is coming to an end. The stock market was up more than 1 percent this morning on news that the House GOP caucus was meeting to debate a plan to raise the debt ceiling on a short-term basis without demanding the defunding or postponement of Obamacare, more than reversing Tuesday’s drop. You can make a good argument that, without the standoff in DC, the market would continue to rise.

That argument, though, actually supports my point: even as the market bounces up and down, it is reacting to the risk—which means, in a market context, the risk is becoming more real. An up bounce on a good rumor may well be followed by a down bounce if the rumor proves false.

What does this mean for our portfolios? I suspect the increase in rates will persist, despite the Fed’s best efforts, as at least some of the rise reflects key investors’ concerns about the government as a whole. (I’m thinking of China and Japan, both of which have publicly warned the U.S. government about the prospect of default.) The recent release of the Federal Reserve’s meeting notes, which suggest the decision not to taper the stimulus program was a very close one, will also probably help to keep rates on an upward trend. Against that is the selection of Janet Yellen as Bernanke’s successor, although what she can do that isn’t already being done is questionable. For equities, I suspect a relief rally will get under way—and may already be under way—when a deal is cut, even if it’s only a short-term one. Enjoy it, because if it is a short-term deal, which is likely, we may end up back here again in short order.

Print

Print