Today’s post is from Brian Price, Commonwealth’s senior vice president of investment management and research.

Today’s post is from Brian Price, Commonwealth’s senior vice president of investment management and research.

Investors in virtually every asset class have experienced positive returns so far in 2019 (knock on wood). Equities and fixed income—two asset classes that have historically demonstrated low correlation to each other—both have delivered notable appreciation over the past 12 months. This dynamic has been mildly confounding to ardent believers in asset allocation, but I’m sure they’ll have their day again soon.

Retail mutual fund investors are not bemoaning the strong market returns they have experienced over the past year. They are forced to confront one minor nuisance, however, in the form of higher capital gains distributions across their taxable accounts.

Portfolio managers buy and sell securities inside of mutual funds throughout the course of the year. Instead of paying taxes on securities that have gains at the point of sale, mutual funds typically wait until the fourth quarter to pay out the “net” short-term and long-term capital gains distributions that occurred throughout the period. This phenomenon can be a negative for mutual fund investors, but there are some resources that I use in my own portfolio when navigating through this cycle.

Estimating taxes

Around Labor Day each year, I start thinking about capital gains distributions in my taxable accounts (exciting, I know!). In the past, I would go to every mutual fund’s website and look up the capital gains distribution information for all of my portfolio holdings. This laborious exercise was less than ideal as I was left clamoring for a resource that aggregated this information in one central location.

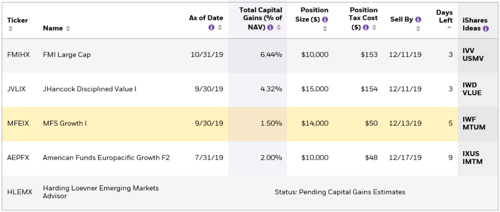

My problem was solved after a friend introduced me to the BlackRock Tax Estimator. After easily uploading my mutual fund holdings on the site, I clicked one button and voila! All the necessary details of the capital gains distributions for my portfolio holdings were available in one report.

Source: BlackRock

Knowing the amounts of the short- and long-term gains distributions for each mutual fund holding has been helpful for my personal tax planning purposes. Perhaps more interesting, however, is the “Sell By” date, which lets me know when I need to be out of a position to avoid the capital gains distribution. I have found this information to be very useful, as I am typically reluctant to purchase mutual funds in my taxable accounts just before they are scheduled to make a distribution.

Unrealized gains/losses

It is important to note that there are other factors that I consider when it comes to avoiding capital gains distributions. Perhaps most obvious is the unrealized gain/loss of the mutual fund in question. Selling a position with an unrealized loss to avoid the distribution has a couple of benefits, but positions with unrealized gains require some additional calculations. At the end of the day, I need to assess if my taxes as a result of selling the position would be higher than if holding the position and paying taxes on that fund’s capital gains distribution.

Adding tax alpha

There are many reasons for investors to cheer as we get ready to close the books on 2019. Opportunities to harvest portfolio losses for tax purposes may not be as prevalent as in years past, but we should be aware of other ways to add tax alpha for clients. Being mindful of the timing and amount of capital gains distributions—and ways to mitigate the effect—will certainly be appreciated when the tax man comes next April.

Print

Print