Today’s post comes from guest contributor Eduardo Ciuffo, a Commonwealth investment research analyst focused on real assets.

Today’s post comes from guest contributor Eduardo Ciuffo, a Commonwealth investment research analyst focused on real assets.

At the end of June, British voters chose to leave the European Union, bringing the country’s 43-year membership to an unexpected end. In its immediate aftermath, the U.K. referendum sent shockwaves across global financial markets. The British pound plunged against the U.S. dollar while stock markets around the world went into freefall.

But the longer-term implications are harder to digest. Let’s consider how these events may impact a very important sector of the economy: real estate.

U.S. real estate market stands to benefit

Despite some short-term volatility, the outlook for the U.S. real estate market continues to be net positive. Although valuations are starting to look frothy in some cases, on average, fundamentals continue to appear strong. In addition, there’s reason to believe the U.S. real estate market could benefit from the fallout of the U.K.’s decision to leave the EU. The current low interest rate environment has been a huge tailwind for the real estate sector, for instance, and the events in Europe could delay the Federal Reserve’s decision to raise interest rates.

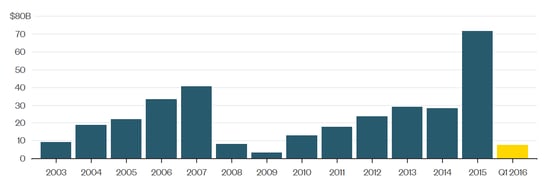

The U.S. real estate market could also benefit from the so-called safe haven effect. The U.S. has long been a top destination for foreign capital looking for safe and stable investments, and real estate has been a great beneficiary. The chart below shows how foreign investments in U.S. real estate assets peaked in 2015 at $71.7 billion. That figure could grow as investors flee U.K./European assets and invest in the U.S. instead.

Foreign Investments in U.S. Real Estate

Source: Jones Lang LaSalle

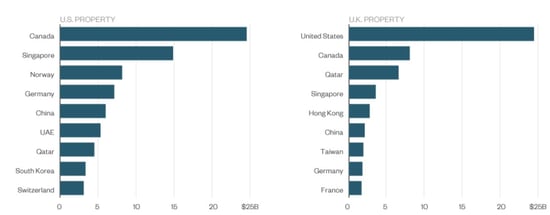

The next chart shows the top sources of foreign capital for both U.S. and U.K. real estate. As the graph suggests, the U.K. and the eurozone have not been significant sources of capital for American real estate. Therefore, any capital disruptions within the eurozone should have a limited impact here at home.

Country of Origin for Largest Direct Property Purchases in 2015

Source: Jones Lang LaSalle

Not such a bright picture for the U.K. market

In contrast, the outlook for the U.K. property market is murkier. As with the U.S., the British real estate market has been a large recipient of foreign capital. According to Jones Lang LaSalle, London was the second most popular destination for foreign real estate investors in 2015, behind New York City. As uncertainty continues to mount, however, it’s likely that some of that capital will make its way across the Atlantic.

Recent events pose some less obvious risks as well. For starters, the U.K.’s decision to leave the EU will continue to be a source of uncertainty for the foreseeable future. More important, however, is the risk that it will fuel other nationalist movements across Europe and abroad. This would mark a reversal of a trend toward globalization and free trade, and it could ultimately lead us down a more protectionist path.

Overall, though the impact of the U.K.’s decision on the global economy appears to be net negative, the U.S. property sector could benefit from positive capital inflows, as well as from an extended period of expansionary monetary policy (i.e., low interest rates). Of course, the verdict is still out on the full effects of the recent vote, and it will likely impact us in some unexpected ways. As the saying goes, it’s almost never the bus you’re watching that hits you.

Print

Print