Brad here. Today’s post is from Peter Essele, one of Commonwealth’s senior portfolio managers on the Preferred Portfolio Services® Select platform. Peter has written here before about a number of investment issues. I think you will find his take on where markets are right now—with special attention to the VIX, which has been in the news a lot of late—is both timely and potentially important. Over to you, Pete.

Brad here. Today’s post is from Peter Essele, one of Commonwealth’s senior portfolio managers on the Preferred Portfolio Services® Select platform. Peter has written here before about a number of investment issues. I think you will find his take on where markets are right now—with special attention to the VIX, which has been in the news a lot of late—is both timely and potentially important. Over to you, Pete.

Measuring complacency

So, has market complacency reached a peak? It certainly appears so. There are many avenues and metrics used to measure complacency across markets; however, two of the most common and widely cited are VIX (CBOE Volatility Index) and the S&P P/E (price-to-earnings ratio).

The VIX measures the market’s expectation of 30-day volatility across a wide range of S&P 500 options. The S&P P/E, on the other hand, equates the price of the S&P to per-share earnings for the underlying companies. In periods of low risk aversion, VIX becomes subdued and the S&P P/E valuation typically moves higher. As a result, both can be used to assess the level of sentiment existing over time.

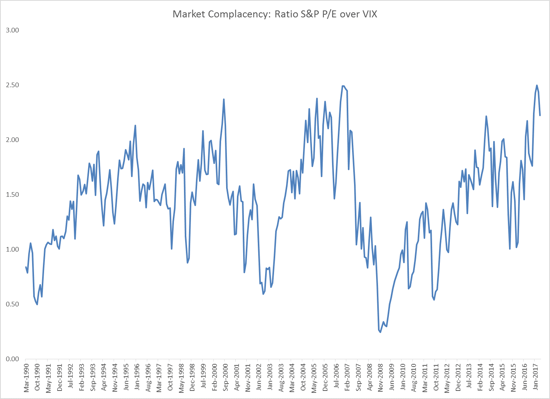

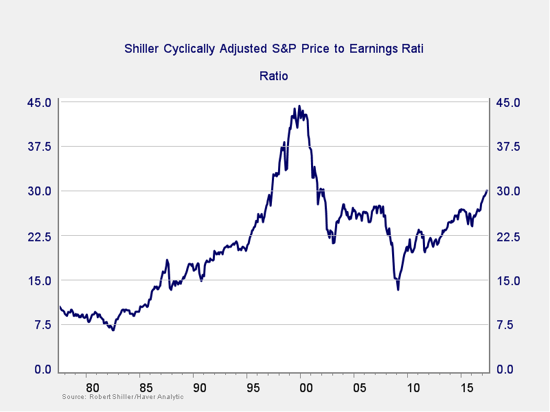

In concert, they can be very useful, especially when combined into a ratio. The chart below shows the ratio of the S&P P/E divided by VIX going back to 1990, where periods close to 0.50 exhibit extreme pessimism and elevated risk aversion (i.e., low P/E and high VIX). For instance, March 2009 witnessed a low level of 15.17 on the Shiller cyclically adjusted S&P P/E and a high level of 45 on the VIX. Currently, these two have significantly reversed, with a very high value of 29.19 for the S&P P/E and a very low level of 13.14 for the VIX. From cheap and nervous, markets have moved to expensive and complacent.

Ratio S&P P/E over VIX

Source: Haver/Commonwealth Financial Network

Source: Haver/Commonwealth Financial Network

What does this mean?

Does this mean we’re due for an imminent sell-off in equity markets? No, probably not. Instead, it suggests that forward-looking returns in the S&P 500 have a good chance of being less desirable than in the period we just experienced based on the historical relationship, as shown in the next chart.

This chart illustrates what the subsequent three-year returns looked like for certain ranges of the Market Complacency Index at each point in time over the last 20 years. For instance, levels between 0.5 and 1.0 on the index have coincided with returns around 60 percent over the following three years based on median scores. On the other hand, levels above 2.0 have seen negative return scenarios. Currently, we’re at a level of 2.22.

Market Complacency and Returns

In light of this, investors should temper forecasts of domestic equity returns over the next three years and consider allocating to relatively attractive areas, such as emerging markets and developed international. These areas still represent attractive growth options, especially with a strong dollar that appears to be weakening as of late after the Trump bump.

Planning our investments

Brad again. To summarize Pete’s point, when markets are cheap and investors are nervous, you can make a lot of money over the next couple of years. When markets are expensive and investors are fat and happy (like now), you could either make considerably less or even lose money over the next couple of years.

This is something we really need to keep in mind when we plan our investments. One of the biggest questions in planning, though, is why this pattern happens. Most of the time, it is because when markets run up, they do have a tendency to correct.

I will be writing about this tendency, and what it means for our immediate future, next week. In many respects, we are in a very risky place right now. Not immediately, as conditions remain supportive—but we can see the storm clouds gathering. The time frame that Pete points out, over the next couple of years, looks very likely indeed.

Print

Print