The one constant in financial services, as in many other industries, is change. And with change comes opportunity. Right now, for example, we’re seeing a record number of advisors participating in some form of a business transition. Whether it’s acquiring a book of business or preparing for the eventual sale of their own practice, M&A activity is something that continues to be a hot topic across all channels of the industry. So, how do you go about finding the right acquisition partner for your financial services firm while continuing to grow your own book of business?

The one constant in financial services, as in many other industries, is change. And with change comes opportunity. Right now, for example, we’re seeing a record number of advisors participating in some form of a business transition. Whether it’s acquiring a book of business or preparing for the eventual sale of their own practice, M&A activity is something that continues to be a hot topic across all channels of the industry. So, how do you go about finding the right acquisition partner for your financial services firm while continuing to grow your own book of business?

Before exploring potential acquisition deals, there are steps you should consider, as well as valuable strategies and tools to take advantage of as you walk through the process.

Need to assess your firm’s scale and capacity? Download our free brochure to learn how our Practice Management team can help.

Look Inside Your Practice

To help mitigate any unexpected challenges, as well as minimize any potential disruptions for your clients, the first step is to take an internal look at your practice.

Conduct a SWOT analysis. Before deciding where you’d like to go, you need to know where you’re starting from. The SWOT analysis is a valuable way to orient you and your practice to the environment in which your business operates today. It clarifies how well the internal attributes of your firm align with the external environment. Once you have a realistic picture of where your firm stands, you will be better positioned to identify appropriate acquisitions that will fit with the values and visions of your practice.

Assess your firm’s scale and capacity. Next, drill down further to your most valuable asset: your clients. Specifically, you need to gauge your firm’s ability to take on another practice by analyzing the revenue sources and profitability of your current clients.

To help position your practice to integrate new acquisitions:

- Develop an ideal client profile. Once you do this, you’ll be better equipped to identify those types of households when assessing a potential practice to acquire.

- Standardize your service matrix. This process will aid you in reviewing the number of services you provide to clients and highlight opportunities to increase scale and profitability.

- Pinpoint internal procedures that present potential bottlenecks in your current service model. Identifying these challenges and finding efficient solutions before taking on additional clients through acquisition is paramount to successful transitions.

Take a financial snapshot. Finally, take a financial snapshot of your practice at least annually. This includes examining many basic but important factors and ratios, including revenue, practice demographics, client overview, and expenses, which informed advisors use to study the compatibility and merits of joining two firms. By performing this annual analysis, you’ll be able to quickly decide whether an outside firm has the potential to meet your standards of quality and structure.

What’s in Your Toolbox?

So, what strategies do you need to ensure that any potential deal is the right one for you and your clients? Our Practice Management team here at Commonwealth has found that the following tools have proven quite valuable to advisors going through the acquisition process.

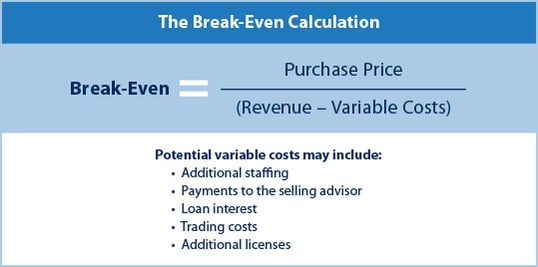

Break-even calculation. When calculating a break-even number, a common mistake is dividing the purchase price by the trailing annual revenue. Often overlooked, however, are the variable costs incurred through an acquisition. The chart below offers a rework of the traditional break-even formula that you might consider when evaluating the attractiveness of an acquisition candidate. You’ll notice that examples of potential variable costs are also included. This list is by no means exhaustive, and you may have additional costs to examine, depending on your acquisition candidates.

Keep in mind that the formula here is intentionally kept simple to create a base from which to start. If you’d like to get more analytical, you can create additional scenarios by adjusting the revenue number to account for growth, retention, and/or market action.

Terms and financing. In a traditional model, practice acquisitions are financed between the seller and the buyer. Generally speaking, the buyer puts a down payment in the range of 20 percent to 40 percent of the total purchase price. The balance is then essentially financed by the seller, as the buyer makes payments over a period of time—usually three to five years. While this structure is still popular, outside financing sources (e.g., Live Oak Bank) have become attractive in helping facilitate deals for acquisition and succession purposes.

Are You Ready?

You know your firm’s needs better than anyone, but be sure to leverage the expertise and experience of others you trust, including attorneys and tax professionals. After all, it always helps to have a sounding board to discuss any opportunity that comes your way. Plus, by using the tools and strategies discussed here, you will be ready when you find the right acquisition partner for your firm.

Have you developed an ideal client profile? What other steps would you take when evaluating an acquisition opportunity? Please share your thoughts with us below!

Editor’s Note: This post was originally published in January 2017, but we’ve updated it to bring you more relevant and timely information.

Print

Print