Featured Insight

Direct Indexing: Personalized, Tax-Efficient Portfolios at Scale

Business Insights for Independent Financial Advisors

Read up on topics ranging from practice management and marketing, to financial and estate planning, to information security, and more.

Running an Independent Financial Advisory Practice with Confidence

Learn how to thrive while running an independent financial advisory practice. Get tips on compliance, operations, marketing, and achieving a balance between independence and scalable growth.

Marketing & Practice Management

Leaving the Wirehouse: Your Guide to Going Independent as a Financial Advisor

Thinking about leaving the wirehouse? From choosing a business structure to charting the course ahead, our guide to going independent provides everything you need to know to achieve the future you've always envisioned.

Marketing & Practice Management

Discussing Strategies for Maximizing Retirement Income

Retirement discussions with clients should not only cover saving and envisioning life after work but also the risk of outliving their savings. Discover how to prepare them for a secure retirement with these tailored strategies and resources.

Wealth Planning & Investing

Scaling for Enterprise Growth with Client Segmentation

Does it feel like you and your staff are at capacity? Segmenting clients and mapping out services to deliver to each tier can help you redirect your energy toward the right people and activities—and create enterprise growth.

Marketing & Practice Management

Year-End Financial Planning: 10 Topics to Discuss with Clients

Ready to make your year-end financial planning discussions with clients as productive as possible? Get started by focusing on these 10 key areas.

Wealth Planning & Investing

Developing Information Security Awareness at Your Advisory Firm

Have you established an effective security awareness program at your firm? To get started, use these helpful guidelines to safeguard your firm's information and educate staff members on common scams.

Cybersecurity & Enterprise Risk

Featured Topics

Year-End Financial Planning: 10 Topics to Discuss with Clients

Ready to make your year-end financial planning discussions with clients as productive as possible? Get started by focusing on these 10 key areas.

Wealth Planning & Investing

Developing Information Security Awareness at Your Advisory Firm

Have you established an effective security awareness program at your firm? To get started, use these helpful guidelines to safeguard your firm's information and educate staff members on common scams.

Cybersecurity & Enterprise Risk

From Instinct to Insight: Helping Clients Overcome Behavioral Biases

How can you empower clients to make better financial decisions? Read this article for tips on helping them overcome behavioral biases that cloud their judgment.

Wealth Planning & Investing

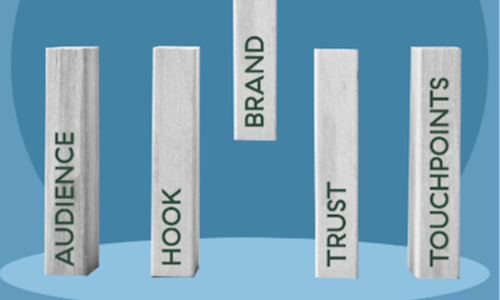

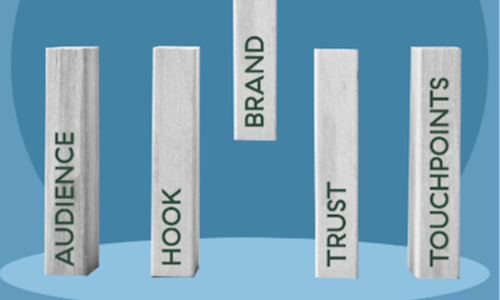

Financial Advisor Branding: Simple Steps to Level Up and Stand Out

How do you build a brand that resonates? Explore this article for financial advisor branding tips that can help attract your ideal clients and grow your firm.

Marketing & Practice Management

Navigating the Regulatory Landscape for Investment Advisers

From off-channel communications to complex products, there are several key areas RIAs need to focus on when navigating the regulatory landscape.

The Fee-Only Advisor

Why Advisors Should Capitalize on the Convergence of Wealth and Retirement

Traditional 401(k) workplace retirement plans can provide a natural segue to new wealth management clients. Learn more about the convergence of wealth and retirement and how you can use it to open doors to providing a broader scope of financial solutions.

Wealth Planning & Investing

How to Choose the Best Firm Partner for Your Advisory Business

Choosing the best firm partner for your advisory business means looking beyond a big name, shiny sign-on bonus, and slick marketing to consider the importance of fit. Here's how.

Marketing & Practice Management