This is a “special edition” of the market risk update. With the recent 10-percent pullback in U.S. markets—something we have not seen in years—the idea of market risk is a concern for many. When we do this analysis, we have to be aware of this but also keep in mind that, over time, longer-term models are better predictors than short-term results (however worrying). As such, we will look at each of our indicators and try to determine how they relate to recent experience. These special sections will be in italics.

This is a “special edition” of the market risk update. With the recent 10-percent pullback in U.S. markets—something we have not seen in years—the idea of market risk is a concern for many. When we do this analysis, we have to be aware of this but also keep in mind that, over time, longer-term models are better predictors than short-term results (however worrying). As such, we will look at each of our indicators and try to determine how they relate to recent experience. These special sections will be in italics.

Market risks come in three flavors: recession risk, economic shock risk, and risks within the market itself. So, what do these risks look like for February? Let’s take a closer look at the numbers.

Recession risk

Recessions are strongly associated with market drawdowns. Indeed, 8 of 10 bear markets have occurred during recessions. As I discussed in this month's Economic Risk Factor Update, right now the conditions that historically have signaled a potential recession are not in place. As such, economic factors remain at a green light, although risks are rising.

Economic shock risk

There are two major systemic factors—the price of oil and the price of money (better known as interest rates)—that drive the economy and the financial markets, and they have a proven ability to derail them. Both have been causal factors in previous bear markets and warrant close attention.

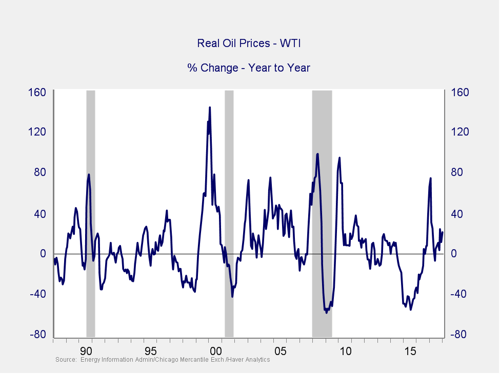

The price of oil. Typically, oil prices cause disruption when they spike. This is a warning sign of both a recession and a bear market.

As we saw with the price spike earlier in 2017, a quick spike—it did not appear to reach a problem level and was short lived—is not necessarily an indicator of trouble. The subsequent decline also took this indicator well out of the trouble zone. That said, we have seen prices start to rise again, to relatively high levels for the period since the crisis, and it bears watching. Overall, however, there are no signs of immediate risk from this indicator, so it remains at a green light.

Signal: Green light

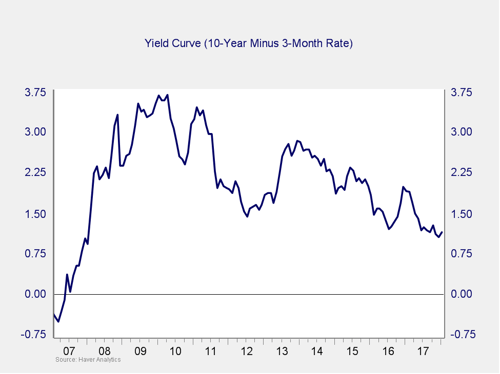

The price of money. I cover interest rates in the economic update, but they warrant a look here as well.

The yield curve spread opened up a bit in January, taking it away from the post-crisis low in December. It is still outside the trouble zone, so the immediate risk remains low. But the fact that it remains close to that post-crisis low, combined with the Fed's expected rate increases, suggests that caution is warranted. I am leaving this measure at a green light for now, but it is getting closer to yellow.

Signal: Green light (with a shade of yellow)

The economic fundamentals remain solid. Although concerns are rising, there are no signs of an imminent recession. As such, the odds of a sustained market drawdown are low. That is not to say we can’t see a further decline—we certainly may. It does say that such a decline, historically, has not lasted that long. Favorable economics support the stock market even during pullbacks.

Market risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

- To recognize what factors signal high risk

- To try to determine when those factors signal that risk has become an immediate, rather than theoretical, concern

Big-picture comment here: you will notice that the recent pullback doesn’t show up on the following charts. That is because they are done on a monthly basis, so we won’t see it until the end of February. This is not a bug; it’s a feature. I have analyzed the best time period for review. Daily is too quick, quarterly is too slow (although better than daily), and monthly is almost always best. Looking every month cuts out quite a bit of the whiplash that can result from daily review. As such, we would not process or react to signals until month-end, which is to say next month’s market risk update. We will talk a bit more about this below.

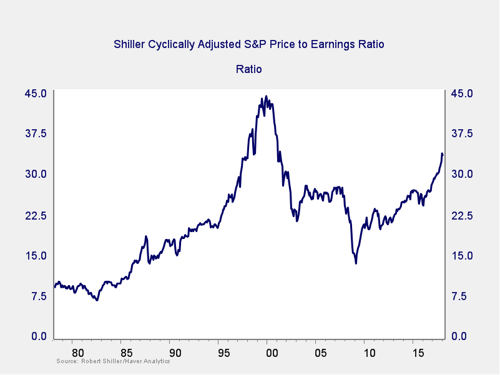

Risk factor #1: Valuation levels. When it comes to assessing valuations, I find longer-term metrics—particularly the cyclically adjusted Shiller P/E ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.

The chart above is interesting for a few reasons. Since the presidential election more than a year ago, equity valuations have increased to levels not seen since the early 2000s. In addition, gains this year have pushed valuations even higher, to the second-highest level of all time. Right now, they are below only 1999, as you can see from the chart.

Although they are at the highest level since 1999, valuations remain below that peak, so you might argue that this metric does not suggest immediate risk. Of course, this argument assumes we might head back to 2000 bubble conditions, which isn’t exactly reassuring.

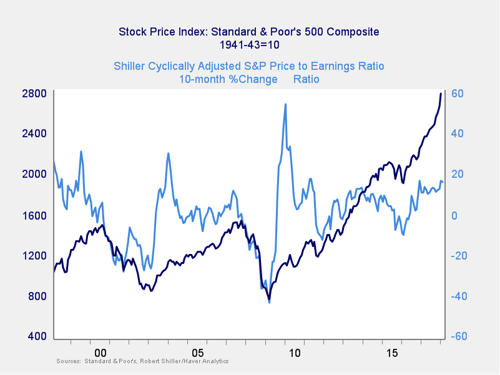

The Shiller P/E ratio is a good risk indicator, but it’s a terrible timing indicator. One way to remedy that is to look at changes in valuation levels over time instead of absolute levels.

Here, you can see that when valuations roll over, with the change dropping below zero over a 10-month or 200-day period, the market itself typically drops shortly thereafter. Strong stock market performance has kept the long-term trend in valuations at a healthy positive level, well above the trouble zone. Therefore, this indicator shows low immediate risk.

Note that valuations dropped with the market decline in early February but not enough to take this indicator into the trouble zone. If the drop persists through month-end, as discussed above, this may result in rising risk, taking this indicator to yellow. But we are not there yet.

Signal: Green light

Risk factor #2: Margin debt. Another indicator of potential trouble is margin debt.

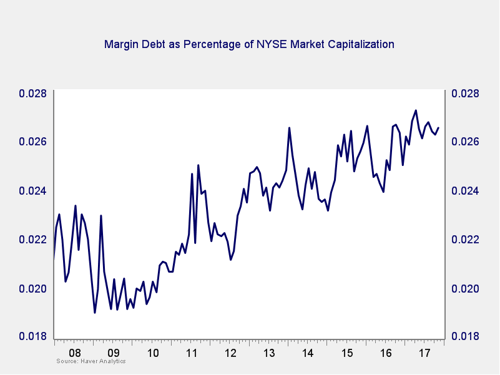

Debt levels as a percentage of market capitalization have moderated over the past couple of months, although they remain close to recent all-time highs. The overall high levels of debt are concerning; however, as noted above, high risk is not immediate risk, and the recent moderation is a positive sign.

For immediate risk, changes in margin debt are a better indicator than the level of that debt. Consistent with this, if we look at the change over time, spikes in debt levels typically precede a drawdown.

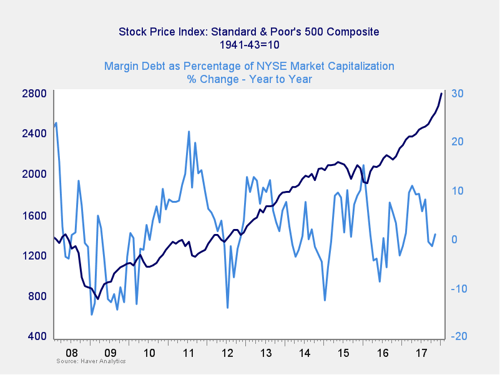

As you can see in the chart above, the annual change in debt as a percentage of market capitalization has ticked back up in the past month, but it still remains close to zero. This indicator is not signaling immediate risk. But the overall debt level remains very high, and we have seen something approaching a spike in recent months, so the risk level remains worth watching. We are keeping this at a yellow light.

Again, this is a metric that we will be taking a close look at next month. There are some signs that margin calls may have worsened the recent turbulence, but it does not appear to be a systemic problem yet. That said, this remains a risk going forward.

Signal: Yellow light

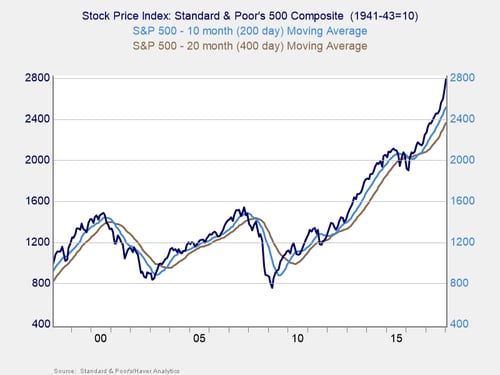

Risk factor #3: Technical factors. A good way to track overall market trends is to review the current level versus recent performance. Two metrics I follow are the 200- and 400-day moving averages. I start to pay attention when a market breaks through its 200-day average, and a break through the 400-day often signals further trouble ahead.

These indicators remain positive, with all three major U.S. indices well above both trend lines. Even as markets continue to reach new highs, it’s quite possible that the advance will continue given growth in earnings and positive consumer, business, and investor sentiment. As we continue to break into new territory, this seems to be actually propelling the market higher, despite the high valuation risk level. With the index well above the trend lines, the likely trend continues to be positive.

The S&P 500 actually dropped slightly below its 200-day moving average at the bottom of the recent drop, but it then bounced and moved higher. If anything, based on the data so far, this suggests that the markets are likely to move higher, since they failed to break support even at the nadir. If they had, it would not really be a worry indicator until month-end. Even then, it would be a potential concern rather than an immediate concern, given the number of false alarms from the 200-day average. Nonetheless, the fact that the index did hit its support level raises risks, so I am taking this indicator down to yellow.

Signal: Yellow light

Conclusion: Conditions weakening, remain favorable overall

The overall economic environment remains supportive, and neither of the likely shock factors is necessarily indicating immediate risk. Similarly, while several of the market indicators point to an elevated level of risk, that risk has not proven out yet. Overall, the risk levels have increased moderately—and may deteriorate further—but the market environment remains favorable in the near term.

We remain at a green light for this month. Given recent turbulence, however, a yellow light next month is a very real possibility.

Print

Print