January’s data was quite good, and improvements in many areas suggest ongoing growth into 2018. Job growth picked back up, and both consumer and business confidence pushed higher. Fed policy remains stimulative, and recent increases in long-term rates steepened the yield curve—often a positive sign. Overall, this month’s data indicates that some of the weakness of the past couple of months may be passing and that the end of the cycle may not be as close as that data had suggested. Some trends do continue to be somewhat worrisome, however, so we’ll be keeping an eye on the economic risks.

The Service Sector

Signal: Green light

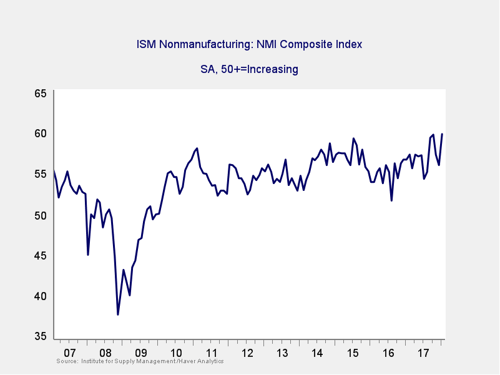

Against expectations of a small increase, the Institute for Supply Management (ISM) Nonmanufacturing index bounced back. The bounce, to 59.9, was a surprise and takes the index close to the post-recession high of two months ago. This sharp bounce, after a pullback, suggests that growth may be more likely to accelerate in 2018. Going forward, these levels of confidence should still support continued growth, leaving this indicator a green light.

Private Employment: Annual Change

Signal: Green light

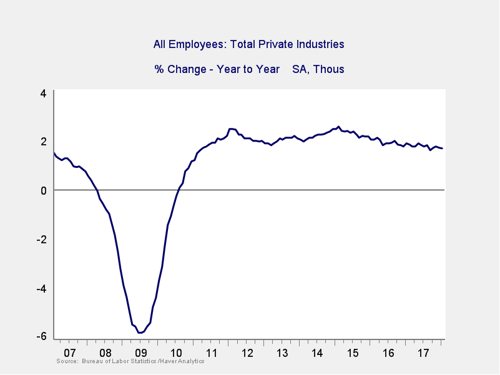

January job growth came in at 200,000, which was well up from December’s level and above expectations. While strong, however, the annual job growth trend continues to inch down. It remains well out of the trouble zone, though, and this month’s strong data will help keep it that way.

Because this is an annual figure, the changes are slower and smaller than those we see in more frequently reported data. Overall, given the volatility of employment growth, this indicator remains a green light, although the current downward trend bears monitoring.

Private Employment: Monthly Change

Signal: Green light

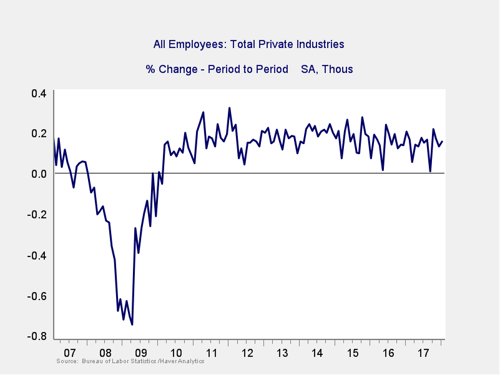

These are the same numbers as in the previous chart but on a month-to-month basis, which can provide a better short-term signal.

As noted above, January was a strong month, reversing much of the December weakness. Overall, job growth is still high enough to keep up with population growth. But the slowdown in hiring in the face of high levels of job openings suggests that labor shortages continue to bite. As with the other signals, this indicator remains a green light, but the risk level is rising.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

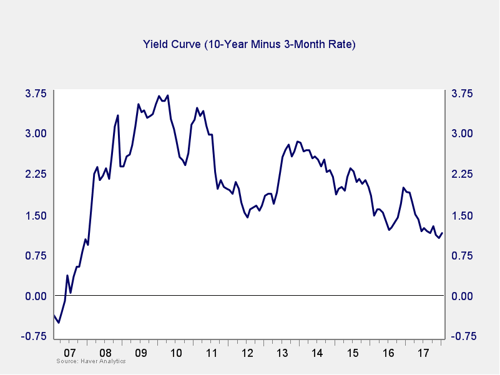

The spread between the 10-year and 3-month rates rose a bit last month, as longer-term rates ticked up in the face of rising inflation risks. A larger spread takes us further away from the trouble zone, so we are leaving this indicator at a green light. Future rate hikes by the Fed might narrow the spread, which will be a key area of concern as we move into 2018.

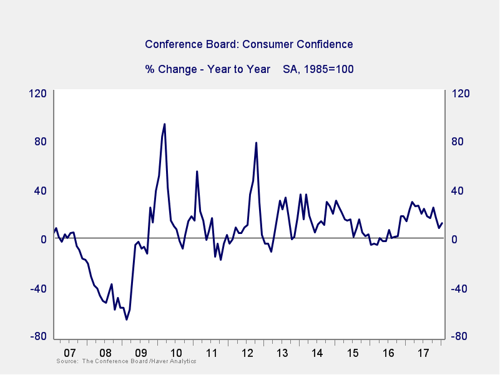

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence bounced back in January after a decrease in December, taking the annual change back up a bit. But the year-on-year change remains close to the lowest levels in more than a year. As with the other indicators, this indicator remains well outside the trouble zone. We are leaving it at a green light but will be keeping an eye on it.

Conclusion: Economy growing, positive trends stable

All four indicators improved on an absolute basis, although the weakening trends remained intact with employment growth and confidence. Overall, while the economy remains solid, growth may be past its peak. The recovery from recent weakness suggests that the end is not nigh, but that weakness also suggests we might be approaching a trouble zone. Conditions remain favorable, and we are still at a green light —but risks are rising.

The economy gets a green light for February.

Print

Print