At this time of the year, finding planning opportunities in clients' tax returns is a goal for many financial advisors. But it's also a chance to assess your clients' overall financial situation, plus add value to the client-advisor relationship.

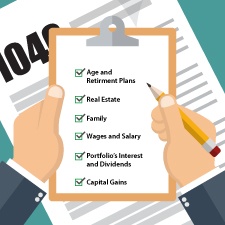

This simple checklist below is designed to help you use the tax return as a road map for exploring future planning strategies. The goal? Learn about your clients' current situation—and how'd they'd like to see it evolve in the future.