After analyzing China, Japan, Brazil, and other economic powers around the world, we come at last to the U.S. An outside view is particularly useful here. As citizens, we tend to think we know all the details, and so we're all the more likely to be caught up in an inside view.

After analyzing China, Japan, Brazil, and other economic powers around the world, we come at last to the U.S. An outside view is particularly useful here. As citizens, we tend to think we know all the details, and so we're all the more likely to be caught up in an inside view.

The benefit of looking at the other countries first is that we now have some context for judging where we stand and what that might mean.

Limited exposure to the rest of the world

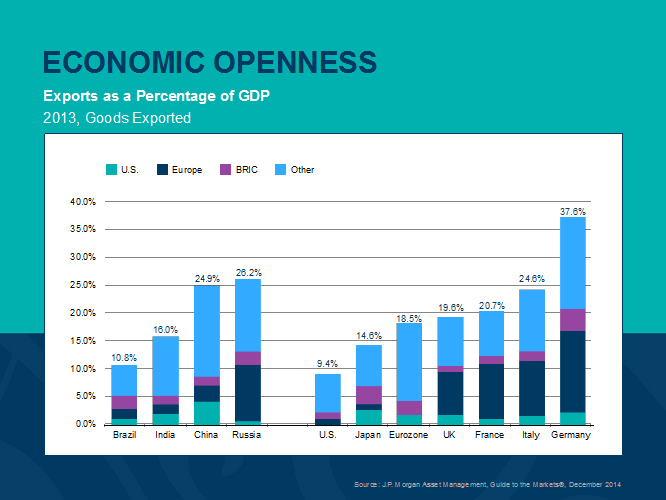

As usual, we'll start with the economic openness analysis. As you can see, the U.S. is by far the most closed of any of the major economies; only Brazil comes close.

Why is this? It’s not because of legal restrictions—the U.S. is an open economy for capital and investment. It’s not because we neither export nor import—we do, at very significant levels. The reason is the sheer size and wealth of the country. We do most of our business internally because there are enough people, who have enough money, to create an independent market.

The contrast with other countries is stark. China has the people but not (yet) the wealth. India has the people but not the wealth. Europe has the people and the wealth, but it's still divided into multiple smaller markets, despite the integration of the eurozone.

Thanks to its unique combination of scale and wealth, the U.S. economy is largely an island. Although it can certainly be buffeted by economic hurricanes, it’s not likely to be sunk by them.

An increasingly competitive export environment

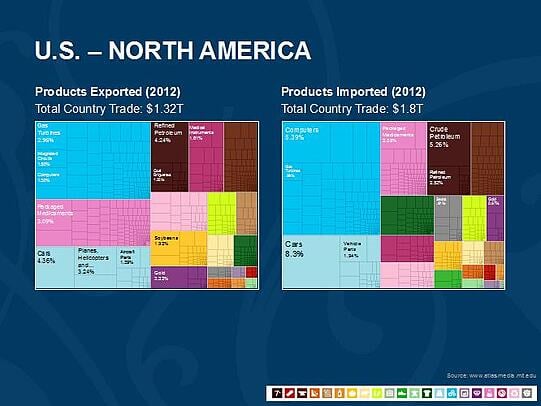

Like Germany, Japan, and China, the U.S. primarily exports manufactured goods, and high-value ones at that. Agriculture is a material part of exports as well, but in general, we compete with the other developed economies. Interestingly, we also primarily import manufactured goods. Oil imports, while material, are much less than those of either China or Europe, due to the large amount of oil we produce domestically.

We can draw a couple of conclusions from this:

- First, just like China, Japan, and Europe, the U.S. will see more competition in the future as it faces off directly against the rest of the developed world for exports. This is not news, but the ascent of China to a directly competitive position will hit the U.S. as hard as it will Europe or Japan.

- Second, although the U.S. will benefit from lower oil prices (because we import less as a percentage of our economy), we will benefit less than either China, Japan, or Europe. As a domestic producer, we will be hurt by lower prices in that segment even as they benefit us in others.

Given these factors, an outside view of the U.S. competitive position raises some issues about growth in the future, particularly relative to other countries.

Fiscal situation under control

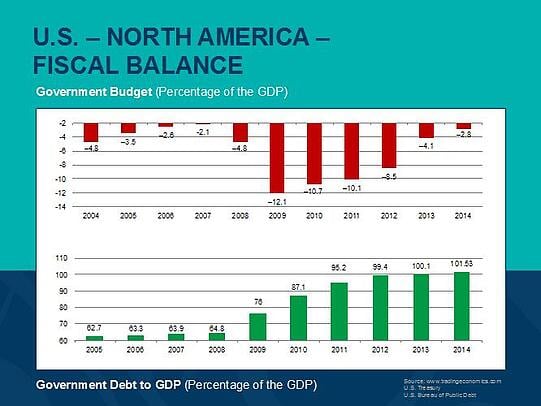

Finally, let’s look at the U.S. fiscal balance. Using the same metrics as we did for the other countries, we can see substantial improvement in the deficit situation, but debt remains at worrying levels.

In comparison with other countries, the U.S. is probably about average overall, with an advantage in the deficit offset by the relatively high debt level. Given how much I have already discussed this, there’s not much more to say.

Conclusion: doing well, for now

Overall, the U.S. appears to be in good shape economically, with relatively low risk in the near term but challenges in the medium to longer term. With the deficit under control for the moment, relatively little exposure to the rest of the world, and a very real boost from lower oil prices, an outside view suggests the U.S. should continue to do well.

Looking out a bit further, though, that same outside view shows that other countries are in many ways better positioned to compete, and future growth will face additional headwinds.

Print

Print