It’s been a while, but it’s time for another COVID update. Compared with a month ago, the medical situation continues to improve, which is good news, although there are reasons to be concerned over the next month or two. The economic news, however, continues to be uncertain. Job growth has slowed substantially in the past couple of months, and confidence remains below the peaks. While markets have continued to do well (as I write this, they are approaching new highs again), there has been volatility and more is likely as we approach year-end.

It’s been a while, but it’s time for another COVID update. Compared with a month ago, the medical situation continues to improve, which is good news, although there are reasons to be concerned over the next month or two. The economic news, however, continues to be uncertain. Job growth has slowed substantially in the past couple of months, and confidence remains below the peaks. While markets have continued to do well (as I write this, they are approaching new highs again), there has been volatility and more is likely as we approach year-end.

Overall, the situation remains uncertain. While prospects are still positive—case growth is trending down, and both the economy and markets retain substantial momentum—we are still in a wait-and-see mode. Let’s take a look at the details.

Case Growth Still Dropping

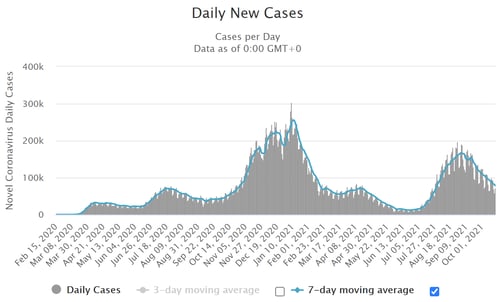

New cases per day. The most obvious metric for tracking the virus is daily new cases. The seven-day average of new cases per day was 78,046 on October 19. This result was down from 103,391 two weeks earlier, a decrease of almost 25 percent over that time period and more than half from the peak of the most recent wave. There has been real progress, although case growth remains high.

One area of concern looking forward is that the fall weather is getting colder, and people (especially in the northern states) are moving back indoors. There is reason to believe that part of the pandemic wave in the South during the summer was due to an “air conditioning” effect, as people went indoors to avoid the heat. We could see a similar “heating” effect this fall. For the moment, however, the news is good.

Source: https://www.worldometers.info/coronavirus/country/us/

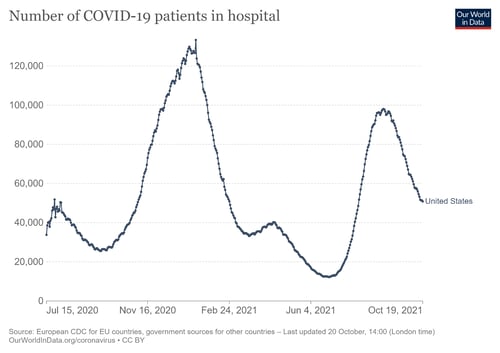

Hospitalizations. We see more consistent improvement in the hospitalization data. On October 19, there were 50,832 people hospitalized, down from 62,485 two weeks earlier, a decrease of almost 20 percent. Hospitalizations typically lag case data, so a further decrease in hospitalizations is likely.

Source: https://ourworldindata.org/covid-hospitalizations

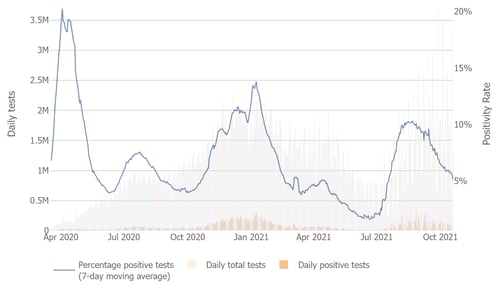

Testing news. The testing news is also getting better, although here too we see volatility in the daily numbers. Overall testing numbers have spiked back up, which is reasonable given the increase in the number of cases. But the positive test rate has come down substantially and is closing in on 5 percent. This is still a level that indicates a more controlled infection exposure environment. So, it seems viral spread is starting to move back under control, although we are not there yet.

Source: Johns Hopkins University

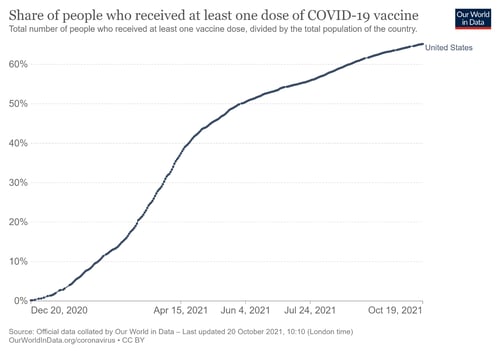

Vaccinations. Another good point is that vaccinations continue to make progress, with almost two-thirds of the population having had at least one shot and well over half being fully vaccinated. As of October 19, 65.2 percent of the U.S. population has had at least one dose of the vaccine, and 56 percent are fully vaccinated. When combined with the people who have contracted the virus, total exposure is likely starting to approach herd immunity levels. This is another positive factor going forward.

Source: https://ourworldindata.org/covid-vaccinations

Economic Risks Rising

Although the medical risks are looking better, the economic damage has continued to mount. Job growth dropped significantly again last month, and consumer confidence remains well below post-pandemic highs. Beyond the pandemic, the expiration of federal subsidy and protection programs is also weighing on sentiment. There are also signs that lower confidence is starting to translate into weaker spending growth, which will be a headwind going forward. Overall, the economy remains open and growth continues, but the risks—especially on the consumer side—are rising.

Future Volatility Likely for Financial Markets

And those rising risks are being reflected in financial markets, which pulled back a bit in the last month before largely recovering. As the rebound suggests, the underlying momentum remains strong, and markets are still supported by low interest rates and expected strong earnings growth. But future volatility remains likely through the end of the year. Whether this rebound continues will be one of the key things to watch in the coming weeks.

Upside Ahead?

We have seen the medical risks potentially top out in the past several weeks as infection growth has continued to moderate. Despite that improvement, the economy has continued to react to the earlier case growth, especially on the consumer side, and this has raised the economic risks and put markets on the defensive. So far, though, the country remains open and the economy is growing. While risks are rising, that will likely continue unless medical conditions get much worse. Markets are cautious, but fundamentals still remain favorable. Volatility is very possible, but there may well be more upside ahead.

Print

Print