This week, I gave a talk at the Commonwealth Leaders Conference where I laid out what I thought was a pretty compelling argument for a continued and strengthening recovery. The problem with arguments like this, especially if you’re taking a position, is that the facts can blow up in your face.

This week, I gave a talk at the Commonwealth Leaders Conference where I laid out what I thought was a pretty compelling argument for a continued and strengthening recovery. The problem with arguments like this, especially if you’re taking a position, is that the facts can blow up in your face.

“Snow-down” slowdown?

We have had some signs of economic weakness recently, largely centered (in my opinion) around weakness elsewhere in the world and winter weather here. And we will probably see more. There has been considerable uncertainty about whether we were going into another “snow-down” slowdown like last year. This made last Friday’s jobs report an important indicator of where we stand.

Good numbers, good news

The suspense is over, and the news is good. In fact, it’s much better than expected: 295,000 jobs were created in February, well above the 235,000 jobs that were expected. The unemployment rate dropped from 5.7 percent to 5.5 percent, and the underemployment rate dropped from 11.3 percent to 11.0 percent. These are good numbers.

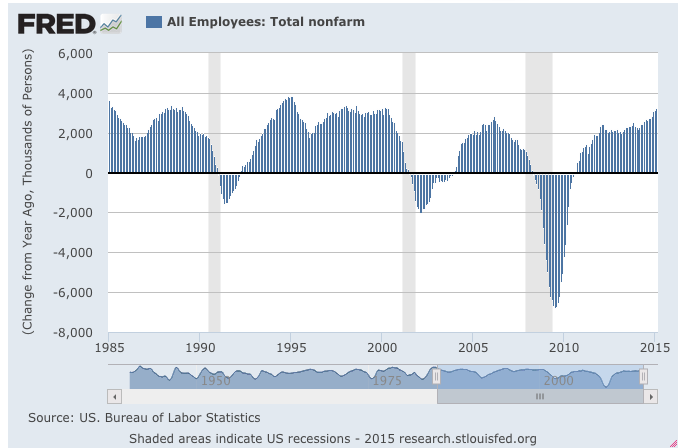

As you can see in the chart above, looking at jobs created year-on-year, we have moved above the highest level we saw in the mid-2000s and are approaching the levels we saw in the late 1990s. Employment growth is approaching boom levels, a phrase I do not use lightly. You could argue we needed that, given the sharp decline during the financial crisis. And that’s true—but job creation is still approaching boom levels.

The problem with wages

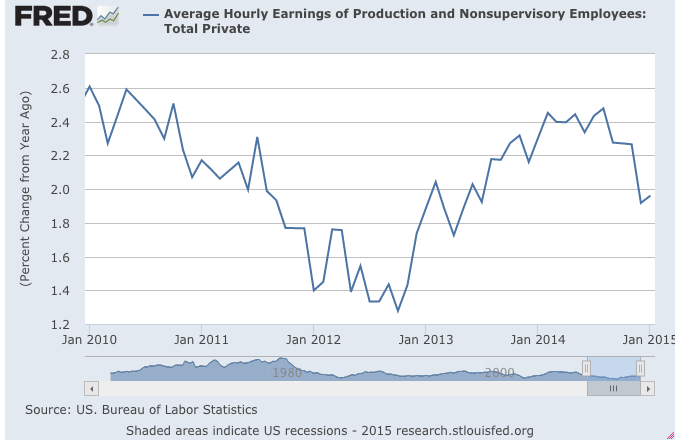

Wages, however, have still not started to accelerate. Average hourly earnings were up only 0.1 percent for the month and 2.0 percent for the year, both down from the prior month. In the chart below, you can see that wage growth, after a substantial recovery, has actually declined over the past several months.

This is a problem. There are several possible reasons for it, none of which is particularly good:

- All of the jobs created could be low-wage jobs, pulling down the overall growth level. That doesn’t jibe with the other data we have, so it’s unlikely to be true.

- There could be a large pool of unused labor that is not being caught by the existing statistics and is holding down wage growth despite the low unemployment rate. This is also probably not the case since the underemployment rate, which attempts to capture that type of hidden labor, dropped by even more than did the unemployment rate.

- The most likely reason is that with living costs dropping, workers may be willing to work for less in the short term to get back into the labor market.

Should we be worried?

Whatever the reason, wage growth remains the real puzzle in the data, and one that gets worse every month. Either of the second two reasons should be corrected as job growth continues. We still have another six months or so before the gap really starts to get worrisome, but it’s something to keep an eye on. For the moment, I am simply happy that job growth continues at a strong level.

Print

Print