In yesterday’s post, I discussed how corporate earnings will likely continue to improve, which should be good for the stock market on a fundamental basis. That’s not the whole story, however.

In yesterday’s post, I discussed how corporate earnings will likely continue to improve, which should be good for the stock market on a fundamental basis. That’s not the whole story, however.

Beyond the base level of earnings is the question of how much investors are willing to pay for those earnings, or the valuation levels placed on them. This is the second—but in many ways, more important—determinant of how the stock market does.

Will valuations start to drop?

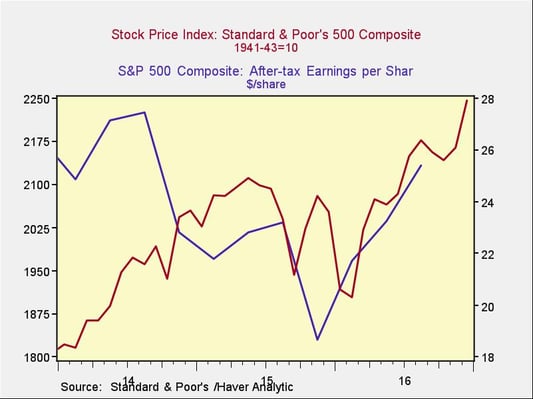

As you can see in the chart below, earnings were declining in 2014 and 2015 even as the S&P 500 Index rose. More recently, of course, the rise in earnings has coincided with a rise in the market, but the market is influenced by much more than earnings themselves.

The question going forward is whether improving earnings will be offset by lower valuations—that is, by investors being willing to pay less for those better earnings. There are reasons to believe that might be the case.

The biggest is that valuations are currently very high—higher than they were in 2007 and 2008, and higher than at almost any point since then.

Stocks are very pricey any way you look at it, and a ratcheting down of valuations would be quite reasonable at this point. The argument for reasonableness of the current high valuations has been largely based on the low level of interest rates, but these are set to rise as well, which would be a second potential headwind. Using standard investment math, higher interest rates make future earnings worth less, which should push down stock prices.

Rising rates tend to be good for the market, at first

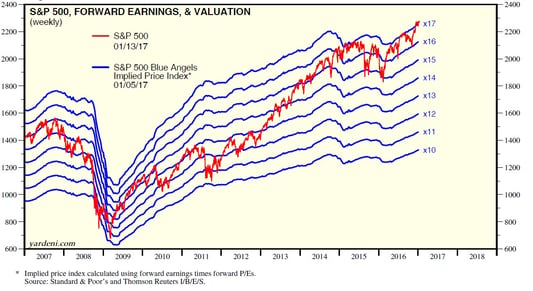

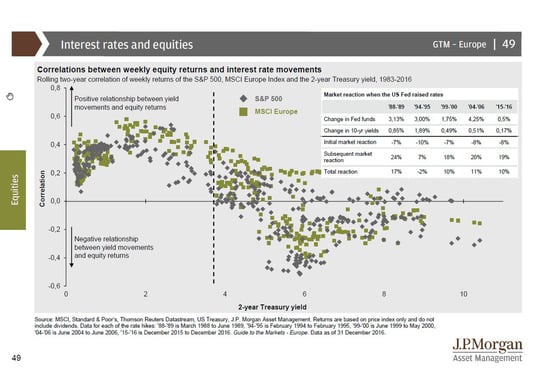

The good news here is that rising rates—at least in the early stages, up to about 4 percent or so—are good for stock returns and good for valuations. The argument is that the positive effects of faster growth, signaled by the Fed’s willingness to start to raise rates, offset the negative effects of modestly higher rates. As this chart from J.P. Morgan's Guide to the Markets shows, this has been consistent throughout developed markets over a long time period.

As we are now in that early stage of rate increases, it is reasonable to expect the rise in rates to be positive (or at least not negative) for stocks. Current high valuations are therefore less likely to be pulled back by rising rates, at least for a while.

Rising confidence another good sign

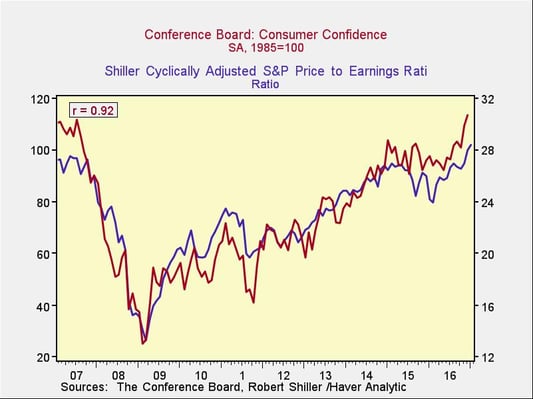

A closer look at the economic improvements that are driving higher rates also gives us another reason to be cheerful, despite the current high valuations: rising consumer confidence has also tended to drive valuations higher.

Over the past 10 years, you can see a very strong correlation between consumer confidence and stock market valuations. With confidence rising strongly, it seems reasonable to expect valuations to continue to rise as well. Combined with faster earnings growth, this could continue to push the market higher.

Risk is high but not immediate

Overall, then, both of the major factors that drive the stock market are positive and could well become even more so. This isn’t to say there aren’t challenges, of course. Risk levels, as I noted in my last market risk update, remain high. With high levels of confidence and expected higher earnings growth, pretty much all of the good news is priced in, which could leave us subject to a pullback if the actual news disappoints. We are certainly in that position now.

At the same time, however, even as risk levels remain high, the immediate risk looks low, and the trend remains positive. In many respects, it is just as risky to be too cautious as not cautious enough. And right now, the news continues to look good.

Print

Print