You can spend all day, every day, looking at and analyzing the plethora of economic and market data. I know, because that’s pretty much what I do. What you find after a while, though, is that much of this information is either redundant or meaningless (or apt to be revised so much that it might as well be).

Does this mean the analysis is a waste of time? Actually, no. In the short term, the markets do indeed react to this stuff, as do investors. A big part of my job, and that of financial advisors, is distinguishing between the short-term ephemera and the longer-term stories that will make a difference.

In talking with the press recently, I’ve been more and more struck with the relentless focus on the now, or at best, the next week. There’s nothing wrong with that—it’s what people watch TV for—but I have a hard time with short-term predictions and analysis. I don’t do them all that well, and I don’t believe that the economy or the markets are predictable in the short term. My usual line goes something like this: “In the short term, I expect the market to either advance or decline. Longer term, things are less certain.” While this is obviously a joke, it captures what I see as the randomness in short-term predictions.

That said, for the medium term, there are stats that can provide meaningful information for both the economy and the markets. I’m currently working on a monthly report format for Commonwealth advisors that will incorporate these measures, but here are a few for your use.

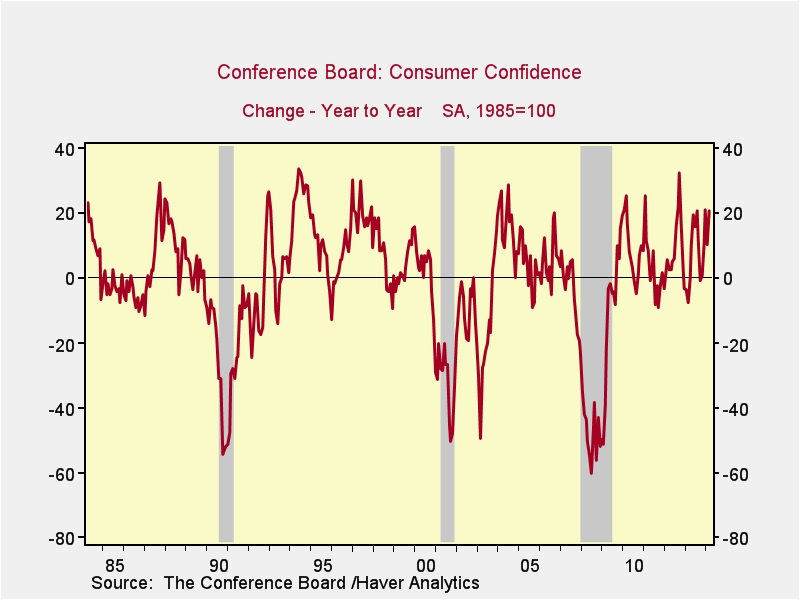

Consumer Confidence

As I wrote last week, consumer confidence and stock market pricing are closely linked. So, too, are consumer confidence and the performance of the economy. If you graph the change in consumer confidence over the previous year for the past 30 years, you find that, three out of the four times that it dropped past −25, we had a recession. The exception was in the mid-2000s, when mortgage equity withdrawals buoyed spending enough to avoid formal recession. This is a very strong indicator—and one that shows we’re nowhere near even a slowdown.

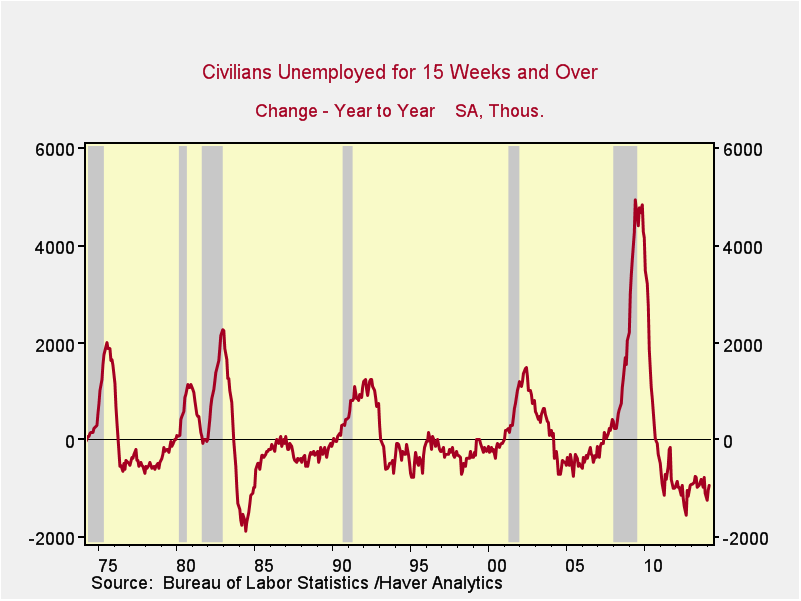

Unemployment

Unsurprisingly, unemployment is also a good gauge of a pending recession. In five out of six cases over the past 40 years, the year-on-year change for the longer-term unemployment figures has climbed above zero shortly before a recession starts. The exception here is the second dip in the early 1980s, when the recovery never really took hold. Again, this indicator shows that we’re nowhere near even a slowdown.

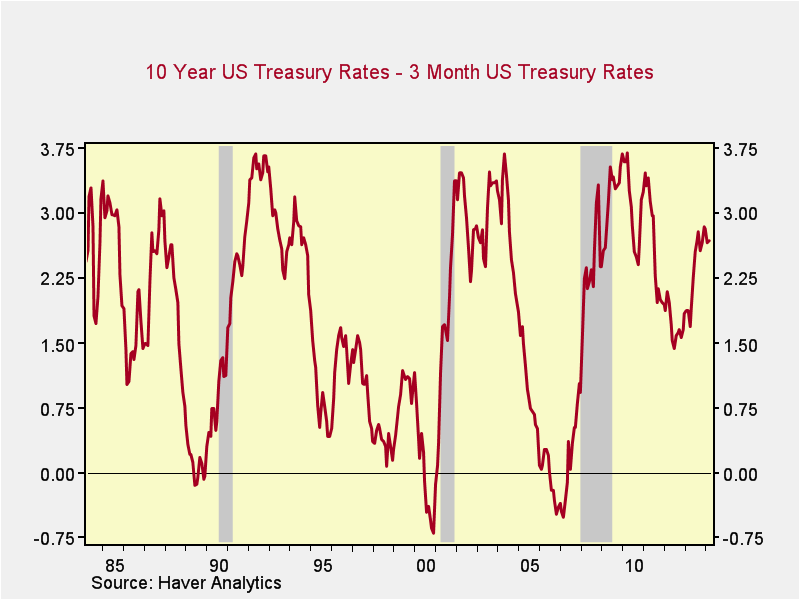

Interest Rates

The difference between longer- and shorter-term rates—in this case, between 10-year and 3-month Treasuries—is also a meaningful warning sign. Longer-term rates should be higher than shorter-term ones; if they’re not, look out. When the difference drops below zero, three out of three times in the past 30 years, a recession has resulted. Again, we’re nowhere near a slowdown by this metric.

While none of these indicators is perfect, each is good, and together they’re very good. None of them is signaling anything in the way of a meaningful slowdown right now. If we’re moving into a slump, it will be for different reasons than in the past—which is possible, I suppose, but I simply don’t see the signs of it at this point.

Print

Print